what is THREE WHITE SOLDIERS CANDLE STICK PATTERN ?

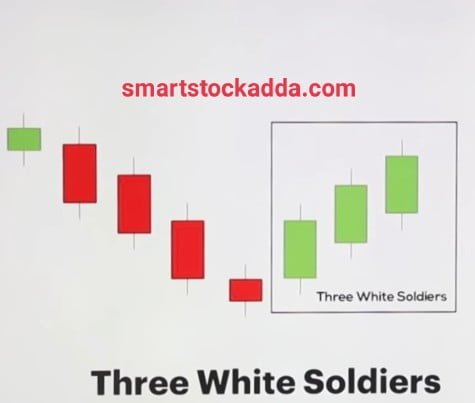

Three White Soldiers is a trend reversal pattern which is seen forming at the bottom (support) of the market chart, after which the possibility of an uptrend in the market is expressed.

How to Identify the Three White Soldiers Candle Stick Pattern ?

Three White Soldiers is a triple candle stick pattern, to identify this candlestick pattern we have to look at the formation of all three candles which should be as follows:-

- First Candle:- The first candle in Three White Soldiers is a green colored bullish candle.

- Second candle: This should also be a green bullish candle, whose open price should be above the middle of the body of the first candle and the closing price should be above the high of the first candle.

- Third Candle:- This is also a green bullish candle, whose open price should be from the middle of the second candle and closing price should be above the high of the second candle.

Keep in mind that this is a bullish trend reversal pattern which should always be formed on support, if it is formed somewhere in the middle of the chart then there is no means of it.

Open demet account angle one click here : https://angel-one.onelink.me/Wjgr/9v76ufmo with 15rs/order brokreage charges top 100 users limited offer.

How to trade with the Three White Soldiers candlestick pattern ?

When we see the Three White Soldiers candle pattern forming at the bottom of the chart, we will set the entry target and stop loss keeping the following things in mind, which are as follows: –

Entry:- When the Three White Soldier candlestick pattern is formed on the support, then whichever candle breaks the high of the third candle of the Three White Soldier pattern among the next 3 candles, then we should take entry in the market from there.

Stop-loss:- We should place the stop loss on this pattern slightly below the low of the first candle.

Target:- In this candlestick pattern, we should always set the target after looking at the resistance or we should set the target two or three times of our stop loss.

Features of the Three White Soldiers Candlestick Pattern ?

The characteristics of Three White Soldiers are as follows:-

- In this pattern the color of all three candles is green.

- All three candles should be bullish candles.

- This indicates reversal in the market.

- When this candlestick pattern is formed, the market is likely to move into an uptrend.

- This pattern should be constructed with support.

- When these three candles are formed, if their volumes are in increasing order, then the chances of market reversal are stronger.

- Along with this candlestick pattern, modern indicators (RSI & MACD) should also be used.

- This candle stick pattern is formed at support after a long-term bearish trend.

Reason for formation of Three White Soldiers candlestick pattern ?

When a particular stock continues to be in recession for a long time, it falls significantly. After that, to maintain it, it is floated in the brokerage form or in the news market, due to which buyers enter the particular stock and the market goes into an up trend. The Three White Soldiers candlestick pattern is formed in that position.

F&Q

1.What type of reversal pattern is the Three White Soldiers?

This is an uptrend reversal candle stick pattern.

2.How many candles are there in the Three White Soldiers Candle Stick?

The Three White Soldiers candle stick is three candles which are bullish candles.

3.Where is the Three White Soldiers Candle Stick Pattern Formed in the Chart?

Support

4.Which Indicator to Use with the Three White Soldiers Candle Stick Pattern

MACD & RSI

Instagram click here

https://www.instagram.com/smartstockadda?igsh=NmloZHgyMTBzcnoz

YouTube channel click here

https://youtube.com/@smartstockadda1?si=wQIeoYfvTebfjCiY

Facebook page click here https://www.facebook.com/profile.php?id=61558073196066&mibextid=ZbWKwL