morning star

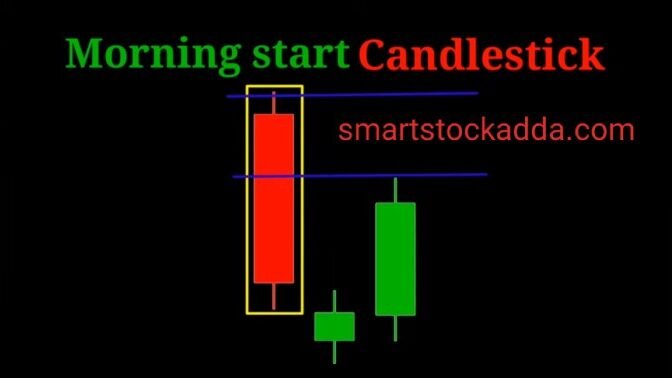

morning star candlestick pattern on chart :-

What is MORNING STAR CANDLESTICK PATTERN ?

The Morning Star Candlestick Pattern is a market reversal pattern that appears to form at support during bearish times, after which there is a strong possibility of an uptrend in the market.

It is formed on support during down trend, after which up trend starts in the market.

This is a triple candlestick pattern which is made up of three candles.

all triple candle stick pattern pdf :-https://smartstockadda.com/category/candle-stick-eg/triple-candle-pattern-eg/

How to identify MORNING STAR CANDLESTICK PATTERN ?

- This is a triple candlestick pattern, so it consists of three candles whose color is very important.

- The three candles of this candlestick pattern should be in the following order

- First Candle:- In this candlestick pattern, the first candle will be a big bearish candle which will indicate that the market is going into recession, its color will always be red.

- Second Candle:- The second candle should be open below the gap of the first candle and its body should be small and its upper and lower shadow should be big. This candle is considered to be formed. It seems that the down trade in the market has now come to an end.

- Its body is two or three times smaller than the shadow.

- Keep in mind that the color of the second candle is not important, it can be any type of red or green or it can be any bearish or bullish candle.

- In this the upper and lower shadows are almost equal.

- This candle is called star because it looks like a star.

- Third candle:- It opens above the gap of the second candle and is a bullish candle.

- Its closing is between the high and mid point of the body of the first candle.

- Its color will always be green

- This is the sequence to form a perfect, complete Morning Star candle pattern.

Open demet account angle one click here : https://angel-one.onelink.me/Wjgr/9v76ufmo with 15rs/order brokreage charges top 100 users limited offer.

Features and significance of the MORNING STAR CANDLESTICK PATTERN ?

- This is a bullish market reversal pattern.

- This candlestick pattern is formed at the end of a down trend after a prolonged recession, after which the market picks up.

- In this candlestick pattern, the first candle is red and the big bearish candle.

- The second candle can be of any type, red or green, and is a candle that looks like a star.

- The second candle is gapped down open compared to the first candle, its body is smaller and its shadow is larger.

- The third candle opens a gap up from the second candle and is a big bullish candle whose closing is between the high and middle of the first candle.

- If this candlestick pattern is seen forming in the support then it is considered very strong.

- This is a triple candlestick pattern which is made up of three candles in which the first candle is red, the second candle is red or green and the third candle is green.

- After the formation of this pattern, the volume of the third candle should be high and the volume of the candles formed after that should also be high, only then it is considered reliable, there can be a reversal in the market and the market can go into an up trend.

- We should also use technical analysis after the formation of this candlestick pattern, such as by using indicators, support resistance, trend line etc., we can increase the accuracy of its industry pattern.

- It is the opposite or reverse of the Evening Star candle stick pattern. The difference between the two is that the Evening Star candlestick pattern is formed on resistance and the Morning Star candle pattern is formed on support.

USAGE OF MORNING STAR CANDLESTICK PATTERN IN TRADING ?

Entry:- After the formation of the Morning Star candlestick pattern, whichever of the next three candles breaks the high of the first candle, we should take entry there.

Stop loss:- In the Morning Star candlestick pattern, we should place the stop loss below the low of the second candle.

Target :- In this candlestick pattern, target should be set after seeing the resistance or two or three times of our stop loss (sl).

Instagram click here

https://www.instagram.com/smartstockadda?igsh=NmloZHgyMTBzcnoz

YouTube channel click here

https://youtube.com/@smartstockadda1?si=wQIeoYfvTebfjCiY

Facebook page click here https://www.facebook.com/profile.php?id=61558073196066&mibextid=ZbWKwL