Long Legged Doji Candle Kya Hai?

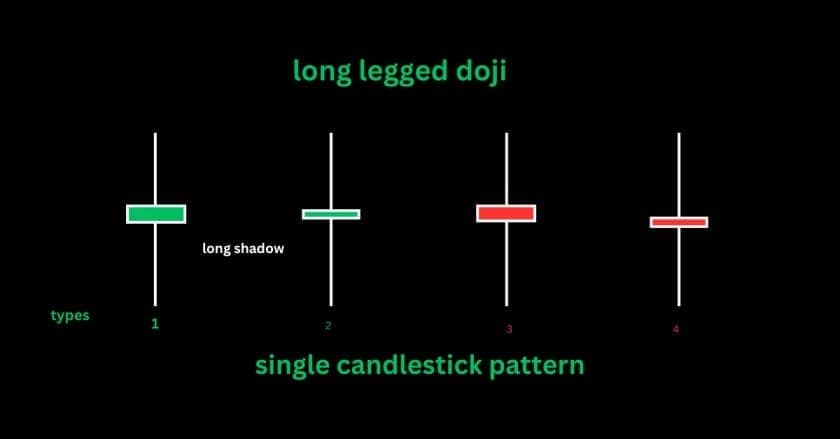

Long legged doji candle ek bahut hi interesting pattern hai jo trading charts par dekha jaata hai. Ye ek aisa candlestick pattern hai jo market ki uncertainity ko dikhata hai. Is pattern ke formation ke doraan, opening aur closing price kaafi close hote hain lekin upper aur lower shadows kaafi lambi hote hain. Iska matlab hai ki buyers aur sellers dono market mein active hain, lekin kisi ek side ka control nahi hai.

Long Legged Doji Candle Ka Importance

Trading ke liye long legged doji candle kaafi important hai kyunki ye market reversal ya trend continuation ka indication de sakti hai. Agar ye candle kisi strong support ya resistance level par banti hai, toh iska signal zyada strong hota hai. Ye traders ko market ki direction samajhne mein madad karti hai.

Long Legged Doji Candle ke sath trading

Long legged doji candle ke sath trading karne ke liye sabse pehle aapko confirmation chahiye hota hai. E.g., agar ye candle bullish trend ke baad banti hai, toh aap upward momentum ka expect kar sakte hain. Lekin, agar ye bearish trend ke baad aati hai, toh aapko downward movement ka dhyaan rakhna hoga. Saath hi, market ki volume ko bhi dhyaan mein rakhna chahiye, kyunki high volume signals stronger trends ko indicate karte hain.

Long-Legged Doji FAQs

1. Long-Legged Doji kya hota hai?

Long-Legged Doji ek candlestick pattern hai jo tab banta hai jab price high, low aur close ke beech ek jaisi distance dikhaata hai, indicating market indecision.

2. Is pattern ka significance kya hai?

Yeh pattern batata hai ki buyers aur sellers ke beech struggle ho rahi hai, aur market ka agla move uncertain hai.

3. Long-Legged Doji bullish hota hai ya bearish?

Yeh na bullish hota hai, na bearish. Yeh ek neutral signal deta hai, lekin market ke agle move ka direction samajhne ke liye context zaroori hai.

4. Yeh pattern kis time frame me zyada effective hota hai?

Daily aur hourly charts par yeh pattern zyada clear aur reliable hota hai.

5. Long-Legged Doji aur normal Doji me kya farak hai?

Normal Doji ka shadow short hota hai, jabki Long-Legged Doji ka shadow kaafi lamba hota hai, jo high volatility ko dikhata hai.

6. Is pattern ko kaise confirm karein?

Next candle ka direction dekhkar confirm karte hain ki market bullish hai ya bearish.

7. Yeh pattern kis market me kaam karta hai?

Yeh pattern stocks, forex, commodities, aur options trading sabhi me kaam karta hai.

8. Support aur Resistance ke saath iska kya role hai?

Agar yeh pattern support ya resistance zone ke paas dikhe, toh reversal hone ka strong chance hota hai.

9. Indicators ke saath Long-Legged Doji kaise use karein?

Indicators jaise RSI aur Moving Average ke saath use karne se confirmation aur strong ho jaata hai.

10. Kya Long-Legged Doji ke baad trade lena safe hai?

Agar proper confirmation mil jaaye toh trade lena safe ho sakta hai, lekin bina confirmation ke risk zyada hota hai.

11. Iska stop-loss aur target kaise set karein?

Stop-loss pattern ke low/high ke thoda neeche/upar lagayein aur target risk-reward ratio ke hisaab se decide karein.

12. Kya Long-Legged Doji trending market me kaam karta hai?

Haan, lekin trending market me isko continuation ya reversal ke signal ke roop me samajhna zaroori hai.

13. Sideways market me iska kya significance hai?

Sideways market me yeh breakout ke signals de sakta hai.

14. Kya yeh pattern reliable hota hai?

Yeh pattern reliable hai, lekin iska accuracy context aur confirmation par depend karta hai.

15. New traders ke liye Long-Legged Doji kaise helpful ho sakta hai?

New traders is pattern ko use karke market ki volatility aur sentiment samajh sakte hain, aur better decisions le sakte hain.