Inverted Hammer Candlestick Kya Hai?

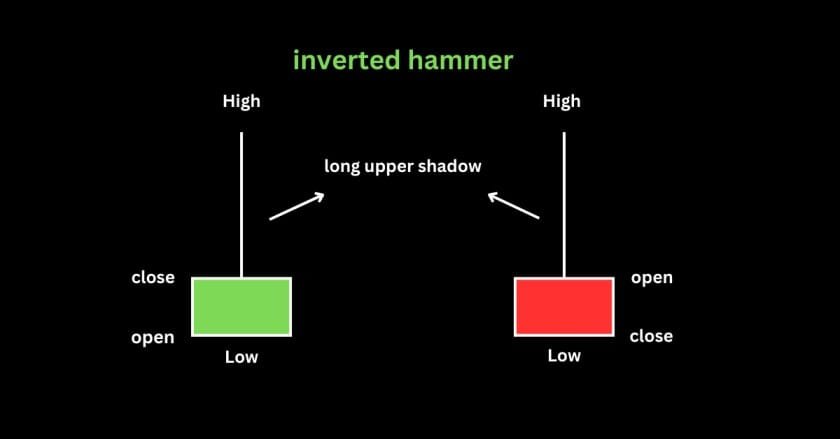

Inverted Hammer Candlestick ek khas type ka candlestick pattern hai jo ki trading charts par dekha jata hai. Yeh pattern usually downtrend ke baad aata hai aur ye sign dikhata hai ki market reversal ki taraf hai. Iska naam ‘inverted hammer’ isliye hai kyunki iska shape ek hammer ke jaise hota hai lekin iska body pehla ghandak ka hissa hota hai jo upar ki taraf hota hai.

Inverted Hammer Candlestick Ka mahtva

Is candlestick pattern ka trading strategies main bahut bada role hota hai. Jab aap kisi stock ya asset ke chart par inverted hammer pattern dekhte hain, toh aap samajh sakte hain ki wahan buying pressure badh raha hai. Ye pattern traders ko batata hai ki wo bullish reversal ke liye tayyar ho sakte hain. Is pattern ko identify karna trading decisions mein madad karta hai aur aapko sahi samay par entry lene ka mauka deta hai.

Trading with inverted hammer in hindi

Inverted Hammer ke saath effective trading strategy ke liye, aapko kuch steps follow karne chahiye. Pehle, confirm karein ki pattern downtrend ke baad hai. Uske baad, aapko next candlestick ka wait karna hoga; agar wo bullish hai, toh yeh confirmation deta hai ki market reversal abhi hone wala hai. Yeh signal maante huye aap trade entry kar sakte hain. Bas dhyaan rahe ki risk management kabhi na bhoolne. Yeh pattern aapko ek acchi opportunity de sakta hai agar aap isse sahi tarike se istemal karte hain.

Inverted Hammer Candlestick FAQs in Hinglish

1. Inverted Hammer Candle kya hota hai?

Inverted Hammer ek bullish reversal candlestick pattern hai jo downtrend ke baad banta hai aur price ke upar jane ka sanket deta hai.

2. Inverted Hammer ka shape kaisa hota hai?

Inverted Hammer candle ki body chhoti hoti hai, upper shadow lambi hoti hai, aur lower shadow ya toh chhoti hoti hai ya bilkul nahi hoti.

3. Inverted Hammer kab banta hai?

Inverted Hammer candle tab banti hai jab price session ke dauraan upar jata hai, lekin close neeche hota hai (opening price ke aas-paas).

4. Inverted Hammer downtrend ke baad hi kyun important hai?

Inverted Hammer tabhi significant hota hai jab yeh ek ongoing downtrend ke baad banta hai, kyunki yeh price reversal ka sanket deta hai.

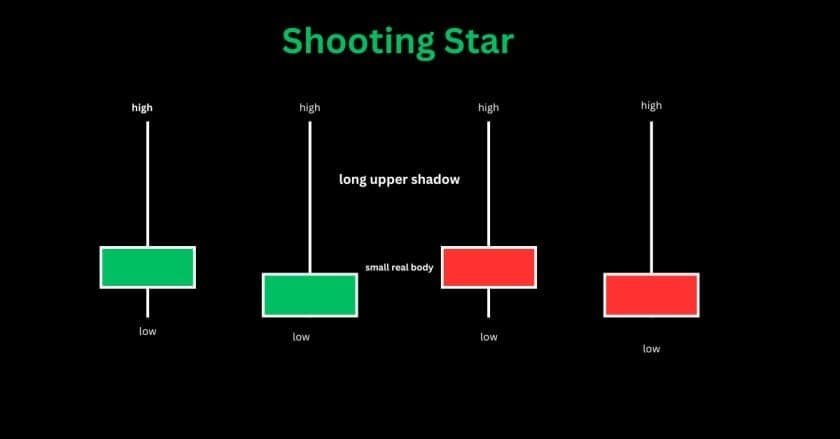

5. Inverted Hammer aur Shooting Star mein kya difference hai?

Inverted Hammer bullish reversal pattern hai aur downtrend ke baad banta hai, jabki Shooting Star bearish reversal pattern hai aur uptrend ke baad banta hai.

6. Inverted Hammer ke liye confirmation kyun zaruri hai?

Inverted Hammer tabhi reliable hota hai jab iske baad ek bullish candle banti hai, jo price ke reversal ko confirm kare.

7. Inverted Hammer kis time frame mein dekhna chahiye?

Inverted Hammer candle minimum 15-minute, hourly, daily, ya weekly charts pe dekhni chahiye, kyunki higher time frames zyada reliable hote hain.

8. Inverted Hammer candle mein volume ka kya role hai?

Agar Inverted Hammer candle zyada volume ke sath banti hai, toh iska reliability badh jata hai, kyunki yeh buyers ki strength ko dikhata hai.

9. Inverted Hammer candle ka stop-loss kaha lagana chahiye?

Inverted Hammer candle ka stop-loss uske low ke neeche lagana sabse safe strategy hoti hai.

10. Inverted Hammer candle ka target kaise decide karein?

Inverted Hammer candle ke target ke liye nearest resistance level ya 1:2 risk-reward ratio ka use karein.

11. Inverted Hammer candle ke liye indicators kaunsa use karein?

Inverted Hammer ke confirmation ke liye RSI, MACD crossover, aur Moving Averages jaise indicators ka use karna helpful hota hai.

12. Inverted Hammer candle har baar kaam karega?

Nahi, Inverted Hammer candle hamesha kaam nahi karta, isliye market context aur confirmation candle ka use zaruri hai.

13. Inverted Hammer candle kis market mein kaam karega?

Inverted Hammer candle stocks, indices, forex, aur commodities sabhi liquid markets mein kaam kar sakta hai.

14. Inverted Hammer candle support level pe kyun important hota hai?

Agar Inverted Hammer candle support level pe banta hai, toh iska reversal signal aur zyada strong ho jata hai.

15. Inverted Hammer candle ka practical use kaise karein?

Inverted Hammer candle ke baad agar bullish momentum dikhta hai, toh yeh ek acha buying signal ho sakta hai, lekin hamesha stop-loss lagana na bhulein.