PATTERN OF DRAGON FLY DOJI CANDLE STICK

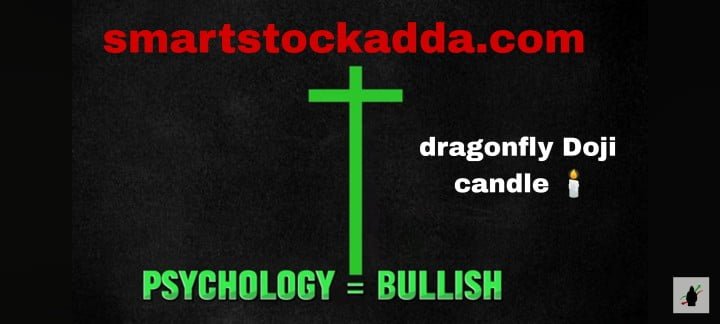

The Dragonfly Doji candle is a type of candle where its candle body is near the high point, and on the low point side, it has a long shadow. Additionally, its open and closing points are very close together, making its body very small. In the Dragonfly Doji candle, the open high and closing points are very close to each other.

All single candle stiicks pattern in full detailed : https://smartstockadda.com/category/candle-stick-eg/single-candle-stick-pattern-eg/

Dragonfly Doji Candle Features

- The Dragonfly Doji candle indicates a reversal in the market or a bullish candlestick pattern.

- In a Dragonfly Doji candle, the lower shadow is long, while the upper shadow is either equal to or very small.

- The Dragonfly Doji candle has a small size, with the open, high, and close points very close to each other.

- It has a long shadow or shade pointing downwards, which is 2 to 3 times larger than its actual body or body.

- Its long shadow indicates that sellers tried hard to push the price down during the session, but ultimately, it recovered and closed near its open price.

- In Dragonfly Doji candles, the color is not significant.

- During a downtrend or bearish market trend, Dragonfly Doji candles appear as support.

- Opposite to the Gravestone Doji candle, it signifies the same thing but the difference is that it indicates bullishness and the Gravestone candle indicates bearishness.

- As the name suggests, the Dragonfly candle in the market is indicating a sudden change to bullishness.

Where is the Dragonfly Doji Candlestick Pattern formed?

We can see Dragonfly Doji candle forming at the bottom of the chart i.e. it can be seen forming below the chart.

This pattern forms in the market when there has been a prolonged period of slowdown. Following this, upon reaching a certain support zone, we see a Dragonfly Doji candle forming, indicating that the market’s downturn is likely coming to an end and a bullish trend may be emerging. After this, we wait for the confirmation by the next candle, which closes above the high of the Dragonfly Doji candle. This signals a momentum shift towards the upside in the market. Then, we can consider taking a trade in the market.

Note that when a double candlestick pattern forms, we need to check the volume in the market along with it. Checking the volume tells us whether the market will go up or not. Because the volume informs us whether buyers are coming into the market or not.

Why does the Dragonfly Doji candle pattern form ?

The main reason behind the formation of the Dragonfly Doji candle is the battle between buyers and sellers. While buyers want to push the market higher, sellers want to drive it lower towards a downturn. So, what happens is sellers initially try to push the market down towards a downturn, but buyers attempt to push the market higher. In this situation, it is observed that the open and close prices of the stock are nearly the same, and it gives a closing near the high, resulting in the formation of a Dragonfly Doji candle.

“Dragonfly Doji candle pattern” is used in trading.

If you want to become a successful trader, you should know about candlestick patterns. One important candlestick pattern is the Doji Dragonfly Doji candlestick pattern. By using this, you can earn good profit in the market.

We always wonder where to enter the market and where to exit, where to place the stop loss, and where to set the target. There is a lot of confusion in all these things. If you have complete information about candlestick patterns, you can easily handle them. Let’s learn about stop loss, target, and entry points in the Dragonfly Doji candle.

Angle one मैं demat account :- https://angel-one.onelink.me/Wjgr/9v76ufmo

DRAGONFLY DOJI CANDLE PATTERN: Where to Enter?

If a dragonfly candle forms at support during a market downtrend, we need to observe the next candle before entering the market. If its closing is above the high of the dragonfly candle, then I can enter there. This is the most crucial time to enter the market, and we must also check the volume. Remember, we will only enter the market if the volume is high.

DRAGONFLY DOJI CANDLE PATTERN: Where to Place Stop Loss?

After entering the market, we should always place a stop loss slightly below the low point of the dragonfly doji candle.

DRAGONFLY DOJI CANDLE PATTERN: How to Set Targets?

Setting a target in the dragonfly doji candle is very easy. We should always set our target at three or four times our stop loss or by looking at the chart in the market and setting the target up to the resistance level.

Instagram:- https://www.instagram.com/smart_stock_adda?igsh=MWk3Z2VoZGZhMDg3dg==

WhatsApp:– https://chat.whatsapp.com/BH4rxUvKCUQ7D7njjCwbHwhttps://chat.whatsapp.com/BH4rxUvKCUQ7D7njjCwbHw