what is DARK CLOUD COVER CANDLESTICK PATTERN ?

The dark cloud cover candlestick pattern is considered a reversal pattern which gives us signals of a down trend in the market.

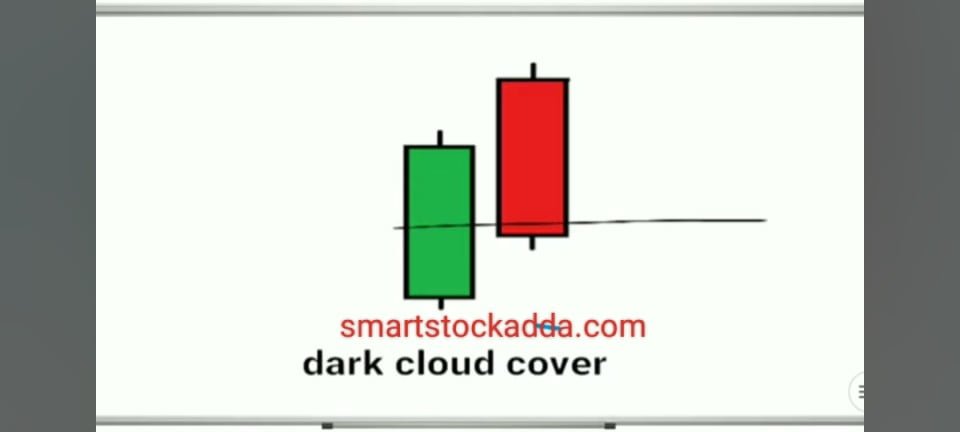

It falls under the category of double candlestick patterns in which the first candle is a large bullish candle while the second candle is a bearish candle. The color of the candles is important in this: The first candle will always be bullish green. The second candle will always be bearish red.

How to identify DARK CLOUD COVER CANDLESTICK PATTERN ?

In the dark cloud cover candlestick pattern, the first candle that appears to form at resistance will have a larger body and will be a large bullish candle. If we talk about the second candle, it is gap-up open compared to the first candle. Its closing point is equal to the open point of the first bullish candle or somewhere in the middle of the body of the first bullish candle.

ALL Single candle stick pattern in one pdf read know : https://smartstockadda.com/single-candlestick-pattern/

Features, characteristics and importance of DARK CLOUD COVER CANDLESTICK PATTERN ?

- The Dark Cloud Cover Candlestick Pattern is a reversal candlestick pattern.

- It is formed at resistance during an uptrend.

- The Dark Cloud Cover candlestick pattern is a double candlestick pattern that consists of two candles: the first candle is a large bullish candle and the second is a bearish candle.

- Color is important in this double candlestick pattern, the first candle should be green and the second candle should be red.

- Dark cloud cover candlestick pattern gives signals for down trade.

- The market starts going bearish after the dark cloud cover candlestick pattern is formed.

- If this candlestick pattern is seen forming on the chart, then along with it we also have to look at the volume of our second candle. If its volume is high then the chances of market reversal are high and also the next candles formed after this. Their volume should also be high, due to which there is a greater possibility of the market going into recession.

- In this double candlestick pattern, the more gap up the second candle opens to form bearish candles, the stronger and more powerful the reversal in the market.

- The only difference between Piercing Candlestick Pattern and Dark Cloud Cover Candlestick Pattern is that Piercing Candlestick Pattern is formed on support which gives bullish signals and Dark Candlestick pattern shows us formation on resistance and gives bearish signals.

- When this candlestick pattern is formed, its signal should be confirmed with technical analysis such as using indicators like trend line, support resistance, etc. We should confirm its signal by looking at all these.

Open demet account angle one click here : https://angel-one.onelink.me/Wjgr/9v76ufmo with 15rs/order brokreage charges top 100 users limited offer.

Use of DARK CLOUD COVER CANDLESTICK PATTERN in TRADING ?

Entry: – If the dark cloud cover candlestick pattern is formed on the resistance, then whichever of the next 3 candles formed after that breaks the low of the first candle, in that case we should enter the market for trading. Should do.

Stoploss (sl): – Stoploss should be placed above the high of the second candle.

Target: – Our target should be set after looking at the support or we should aim at two or three times the stoploss.

Instagram click here

https://www.instagram.com/smartstockadda?igsh=NmloZHgyMTBzcnoz

YouTube channel click here

https://youtube.com/@smartstockadda1?si=wQIeoYfvTebfjCiY

Facebook page click here https://www.facebook.com/profile.php?id=61558073196066&mibextid=ZbWKwL