Dark Cloud Cover Pattern Kya Hota Hai?

Dark cloud cover ek technical analysis pattern hai jo stocks, commodities, aur currencies mein bearish reversals ki taraf ishara karta hai. Ye pattern tab banta hai jab kisi bhi financial instrument ke price ki do baar movement hoti hai, pehli baar wo upar ki taraf badhta hai aur dusri baar ye lower commence karta hai, ye dark cloud cover pattern kehlata hai.

Dark Cloud Cover Ko Kaise Identify Karein?

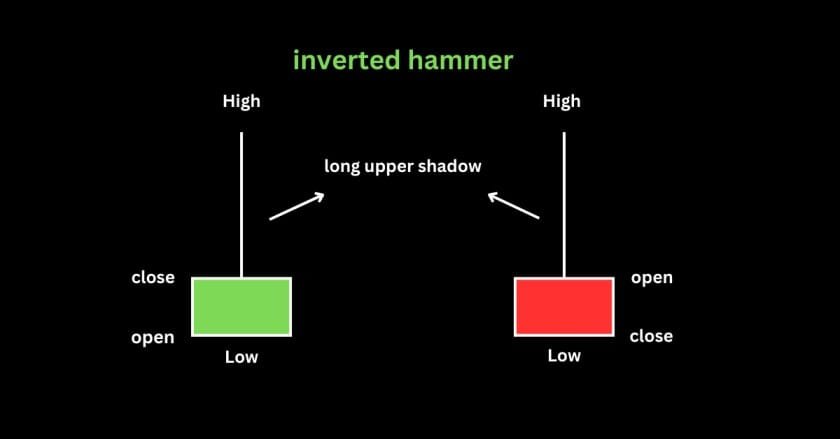

Dark cloud cover pattern ko identify karne ke liye, sabse pehle aapko market ki charts par nazar rakhni hogi. Ye pattern do candlesticks ka combination hota hai. Pehli candlestick bullish hoti hai aur dusri candlestick iske kaafi upar se open hoti hai, lekin iske close price pehli candlestick ke mid point se neeche hoti hai.

Dark Cloud Cover ke sath Trading

Yadi aap dark cloud cover pattern se trading karne ka soch rahe hain, to neeche diye gaye bullet points ko aap consider kar sakte hain:

- Confirmation Candlestick: Dark cloud cover ke baad ek bearish confirmation candle ki talash karein.

- Stop Loss Set Karein: Stop loss ko previous high se thoda upar set karein taaki risk management achha ho.

- Target Price Decide Karein: Target price ko desired risk-reward ratio ke adhar par tay karein.

- Market Conditions Analyze Karein: Market ke general trend aur news ko dekhein jo situation ko impact kar sakte hain.

Yeh kuch basic guidelines hain jo aapko help kar sakte hain dark cloud cover pattern istemal karne mein, lekin hamesha market ki volatility ko samajhna na bhoolen!

FAQs

1. Dark Cloud Cover pattern kya hota hai?

Dark Cloud Cover ek bearish reversal candlestick pattern hai jo tab banta hai jab ek green candle ke baad ek red candle aati hai, jo pehli candle ke body ke upar se start hoke uske midpoint ke neeche close hoti hai.

2. Dark Cloud Cover pattern kaise identify karein?

Is pattern mein:

- Pehli candle bullish (green) hoti hai.

- Doosri candle bearish (red) hoti hai jo pehli candle ke high ke upar se open hoti hai aur uske body ke midpoint ke neeche close hoti hai.

3. Kya Dark Cloud Cover pattern hamesha trend reversal dikhata hai?

Nahi, yeh hamesha reversal guarantee nahi karta. Lekin agar yeh resistance level ya overbought zone mein bane, toh iska signal zyada reliable hota hai.

4. Dark Cloud Cover pattern ke baad stop-loss kahan lagana chahiye?

Stop-loss pehli bullish candle ke high ke upar lagana chahiye, taki agar price wapas bullish ho, toh loss limited ho.

5. Dark Cloud Cover pattern ko confirm kaise karein?

Confirmation ke liye aap agle ek ya do candles ka wait kar sakte hain. Agar price neeche jata hai aur selling volume high hota hai, toh pattern confirm ho sakta hai.

6. Dark Cloud Cover pattern ka best use kis time frame par hota hai?

Iska use higher time frames (jaise daily ya 4-hour charts) par zyada reliable hota hai, lekin intraday traders ise 15-min ya 30-min charts par bhi dekh sakte hain.

7. Dark Cloud Cover aur engulfing bearish pattern mein kya difference hai?

Dark Cloud Cover mein doosri red candle pehli green candle ko puri tarah engulf nahi karti, sirf uske midpoint ke neeche close karti hai. Jabki bearish engulfing pattern mein red candle green candle ko poora cover karti hai.