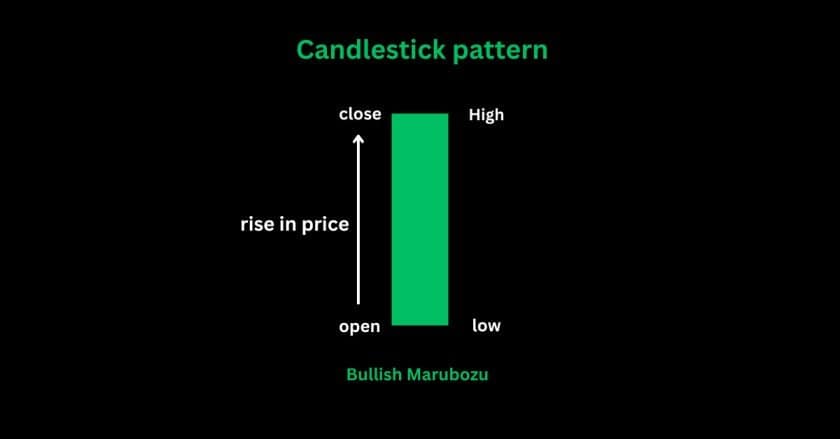

Bullish Marubozu kya hai

Bullish marubozu candlestick pattern trading ki duniya mein ek ahem term hai. Yeh ek aisa saboot hai jab market ka trend upward chalta hai aur prices opening se lekar closing tak, bina kisi shadow ke, steadily barh rahe hote hain. Is pattern ki sabse badi pehchaan yeh hai ki yeh total bullish mood dikhata hai, jahan buyers market par hakim hote hain.

bullish marubozu Pehchan Kaise Karein?

Bullish marubozu pattern tab banta hai jab ek candlestick ki opening price lowest price hoti hai aur closing price highest price. Is tarah se, yeh candle body long hoti hai aur completely filled hoti hai, jo ek strong buying sentiment ko darshati hai. Traders is pattern ko momentum samajhte hain, jo upcoming price movement ke liye bhi signals de sakta hai.

bullish marubozu ke sath Trading

Agar aap bullish marubozu ki signal ki pehchan karte hain, toh yeh aapko ek opportunity deta hai trading ke liye. Is pattern ko dekhkar aap entry point tay kar sakte hain, jaise hi aapko do consecutive bullish marubozu candles dekhein toh aapko lagta hai ki market bullish hai. Stop-loss hamesha zaroor include karein taaki investment protected rahe. Aakhir mein, bullish marubozu pattern ek powerful tool hai, lekin isko dusre indicators ke saath integrate karna hamesha acha hoga.

FAQ

1. What is a Bullish Marubozu?

Bullish Marubozu ek candlestick pattern hai jo strong buying pressure ko represent karta hai. Isme candle ka opening price low hota hai aur closing price high, bina kisi upper ya lower shadow ke.

2. How to Identify a Bullish Marubozu on a Chart?

Chart par Bullish Marubozu ek solid green candle hoti hai, jisme sirf body hoti hai aur koi shadow nahi hoti.

3. What Does a Bullish Marubozu Indicate?

Yeh pattern dikhata hai ki buyers poori tarah se control mein hain, aur price ke aur upar jaane ki probability zyada hai.

4. Is Bullish Marubozu Always Reliable?

Nahi, yeh akela reliable nahi hota. Trend confirmation ke liye additional technical indicators ya price action analysis ka use karna zaroori hai.

5. What Timeframes Are Best for Bullish Marubozu?

Higher timeframes (jaise daily ya hourly) par Bullish Marubozu ka analysis zyada reliable hota hai, lekin intraday trading ke liye bhi yeh kaam aa sakta hai.

6. Can Bullish Marubozu Be Used in Intraday Trading?

Haan, intraday trading mein yeh ek quick buying opportunity signal kar sakta hai, agar support aur volume ke saath confirm ho.

7. What Should Be the Stop Loss for Bullish Marubozu Trades?

Stop loss usually candle ke low ke neeche set kiya jata hai, kyunki agar price wahan tak aaye toh pattern fail ho sakta hai.

8. How Does Volume Affect Bullish Marubozu?

High volume ke saath Bullish Marubozu pattern zyada reliable hota hai, kyunki yeh confirm karta hai ki buyers actively participate kar rahe hain.

9. What Is the Difference Between Bullish Marubozu and Bearish Marubozu?

Bullish Marubozu buying pressure dikhata hai, jabki Bearish Marubozu selling pressure ko highlight karta hai. Dono ke shadow nahi hote, lekin ek green (bullish) hota hai aur doosra red (bearish).

10. Can Bullish Marubozu Appear in Bearish Trends?

Haan, lekin bearish trend mein iska significance kam ho sakta hai. Yeh reversal ya pullback ka signal de sakta hai.

11. What Is the Role of Bullish Marubozu in Price Action?

Bullish Marubozu price action analysis ka ek strong bullish signal hai, jo buying momentum ko dikhata hai.

12. How to Trade Bullish Marubozu Effectively?

Trade karte waqt Bullish Marubozu ke saath support levels, trend lines, aur volume confirmation ka use karna chahiye.

13. Can Bullish Marubozu Appear in Consolidation Phases?

Haan, lekin consolidation phase mein iska breakout ke liye wait karna zaroori hota hai.

14. What Are the Limitations of Bullish Marubozu?

Yeh pattern akela reliable nahi hota. Hamesha doosre technical tools ke saath use karna chahiye for better accuracy.

15. Why Is Bullish Marubozu Popular Among Traders?

Yeh pattern simple aur easy-to-spot hota hai. Clear buying pressure dikhane ki wajah se yeh traders ke beech popular hai.