bullish engulfing

view on chart bullish engulfing :-

What is THE BULLISH ENGULFING PATTERN?

The Bullish Engulfing Pattern is a bullish candlestick pattern in which it can be seen forming on the support of a stock which is in down trade. After its formation on the support, it is believed that the market is now trending. Reversal is going to happen, market is going to rise.

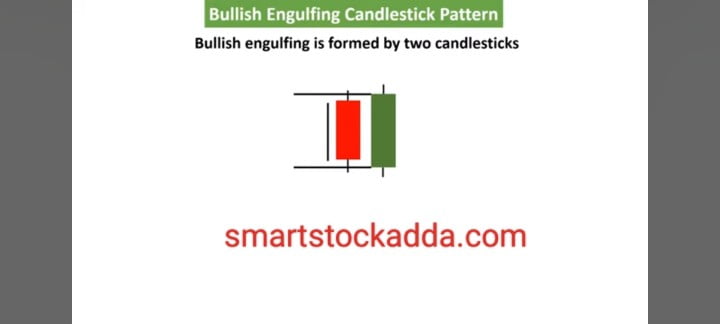

This is a double candlestick pattern which consists of two candles, the first candle is red which indicates bearishness and the second candle which is green which indicates bullishness.

THE BULLISH ENGULFING PATTERN What type of formation can be seen on the chart ?

This pattern can be seen forming on the chart as follows:-

ALL Single candle stick pattern in one pdf read know : https://smartstockadda.com/single-candlestick-pattern/

Use of THE BULLISH ENGULFING PATTERN in TRADING ?

To use it for trading, we will focus on three things: first, how to enter the market through it, where to set stoploss and how to set target.

ENTRY:-

When this candlestick pattern is formed in support, then whichever of the three candles formed after it breaks the high of the second candle, we have to take entry in the market.

STOP LOSE :-

It is very easy to set stop loss in this. We should always set stop loss slightly below the low of the second bullish candle.

TARGET:-

Talking about the target, we should always set the target after looking at the resistance or we should set the target which is two or three times our STOPLOSE.

Open demet account angle one click here : https://angel-one.onelink.me/Wjgr/9v76ufmo with 15rs/order brokreage charges top 100 users limited offer.

How to recognize THE BULLISH ENGULFING PATTERN ?

bullish engulfing candle

To identify the Bullish Engulfing Pattern, we have to keep the following things in mind: –

- As you can see in the picture, we have tried to explain this pattern to you through the picture. If you look at the candles here, always keep this in mind that the first candle is equal to or smaller than the second candle.

- And always remember that the first candle will be a bearish candle which will always be red and the second candle will always be a bullish candle which will be green.

Characteristics, features and importance of THE BULLISH ENGULFING PATTERN !

- This is a double candlestick pattern indicating bullishness.

- It is formed at a time of prolonged recession in the market.

- It will work only when it is built on support.

- If instead of being formed on support, it is formed in the middle of the chart or on resistance, then it has no significance.

- In this, the first candle will always be red and the second candle will always be green.

- We see this forming during down trades.

- Keep in mind that when this candle stick pattern is formed on support, the volume of the second candle accompanying it, which is a bullish candle, should be high. If the volume is not high then it can also become a fake candlestick pattern.

- The first candle in this pattern can be smaller than or equal to the second candle but the first candle will never be bigger than the second candle. If this happens then it is not a Bullish Engulfing Pattern.

- Once this candlestick pattern is formed on the chart, any one of the next three candles, which is bullish, should break the high of the other candle, otherwise it will not be considered as a strong reversal.

- When the pattern is formed, we should also use modern indicators like:- RSI & MACD. When this pattern is formed, the value of rsi should be close to 60.

Psychology of forming THE BULLISH ENGULFING PATTERN ?

When the market continues to move in down trade, it reaches support and forms a bearish candle, which is a market candle which indicates that the downward trend in the market is continuing.

After this, a big bullish candle is formed on the support of the second candle, which tells us that the sellers in the market are becoming weak and the buyers are becoming dominant in the market, due to which there can be a change in the market. Can go into up trend.

Relationship between THE BULLISH ENGULFING PATTERN and VOLUME ?

Volume becomes important in any candlestick pattern because if the volume is not high then the chances of reversal are negligible.

The Bullish Engulfing Pattern The same is true in the pattern, in this the volume of the second candle which is bullish should be more than that of the first red candle, only then the reversal is considered strong, hence it is very important that the volume of the second candle which is bullish should be more and the partner has candlestick. If the volume of the next candles formed after the formation of the pattern is also in increasing order, then it will become a very good train reversal.

Instagram click here

https://www.instagram.com/smartstockadda?igsh=NmloZHgyMTBzcnoz

YouTube channel click here

https://youtube.com/@smartstockadda1?si=wQIeoYfvTebfjCiY

Facebook page click here https://www.facebook.com/profile.php?id=61558073196066&mibextid=ZbWKwL