BEARISH KICKER

What is the Bearish Kicker candlestick pattern?

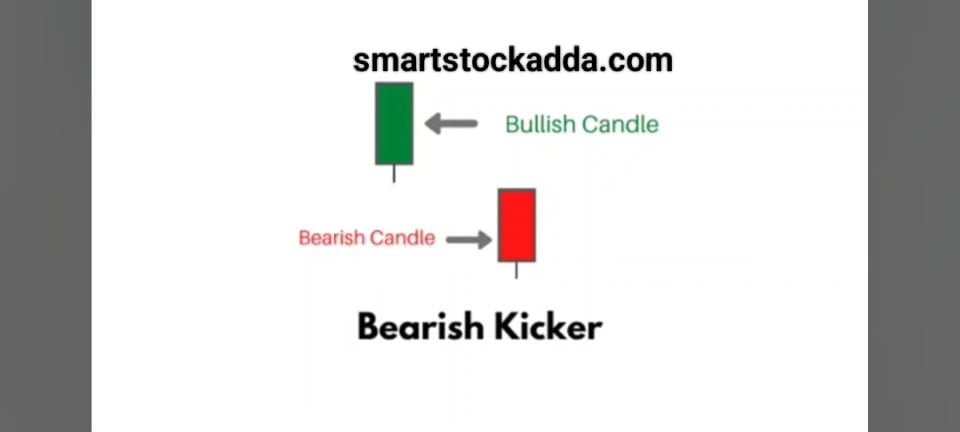

Bearish Kicker Candlestick Pattern is a bearish pattern that is formed at the resistance, top of the chart after a long bullish trend. In this, the first candle is green and the second candle is red. The second candle between these two is the gap down of the first candle. Is open. And after the formation of candlestick pattern, it is believed that there is a recession in the market.

ALL Single candle stick pattern in one pdf read know : https://smartstockadda.com/single-candlestick-pattern/

How to identify BEARISH KICKER CANDLESTICK PATTERN ?

The Bearish Kicker candlestick pattern is quite easy to identify.

- It should be made in fast time

- This candlestick pattern is formed by reaching resistance.

- In this, first a bullish candle is formed.

- In this the second candle becomes a bearish candle.

- If there is a gap between the first and second candles, then this pattern is considered very powerful.

- When the second candle is formed after the first candle is formed, if it is gap down open then the pattern is that much stronger.

- This pattern copy becomes stronger if the second candle opens below the first candle and closes below it.

- Sometimes this candle looks like a marobuzu candle to us, it does not mean that it should be a marobuzu candle, if it is not a marobuzu candle it is still considered effective.

- The first candle can be any of the following bullish candles:- Marubozu, Hammer, Doji.

- he second candle has a larger actual body.

Importance and features of BEARISH KICKER CANDLESTICK PATTERN ?

After the formation of Bearish Kicker Candlestick Pattern, there are signs of recession or decline in the market.

- This shows recession in the market.

- In this the first candle is green and the second candle is red.

- These candles are like marobuzu candles.

- After the formation of the first candle, the open and close price of the second candle should be below the low of the first candle.

- The second candle should be gap down open compared to the first candle.

- This candle stick pattern is formed during bullish times.

- This candlestick pattern should be formed at resistance.

- Bearish Kicker Candlestick Pattern is considered a reversal or negative pattern.

you can open your Demat account in our favorite broker ANGLE ONE LTD. can do :-

For this click on the link given below

Link :– https://angel-one.onelink.me/Wjgr/3x0hl7x1

What do the first and second candles in the BEARISH KICKER CANDLESTICK PATTERN indicate?

Bearish Kicker Candlestick Pattern

If the pattern is formed during the bullish period, then the first candle formed in it is the green candle and the first candle indicates the current bullishness in the marke

The second candle opens much lower than the closing price of the first candle, which indicates the difference in the opening prices of the first and second candles. The second candle has a larger actual body, which creates strong selling pressure in the market and indicates a decisive move in a bearish context.t. It can be any bullish or bullish candle like

Maruboju, Hammer, Doji.

RELATIONSHIP IN BEARISH KICKER CANDLESTICK PATTERN AND VOLUME ?

When this double candlestick pattern is formed, if the volume of the second candle is higher then this pattern is considered very strong and the chances of reversal are very high, hence we should always check the volume of the second candle if its volume is higher. But there is a strong possibility that the market may fall.

Use of BEARISH KICKER CANDLESTICK PATTERN in trading ?

Bearish Kicker Candlestick Pattern is considered very easy to use in trading, so we know closely when to enter the market, what should be our stop loss and target.

When to enter the market after forming the BEARISH KICKER CANDLESTICK PATTERN?

After the formation of Bearish Kicker Candlestick Pattern, if the next candle formed after it breaks the low of the second candle or opens below the second candle, then it is the right time to enter the market. I should also check the volume to make sure it is high.

BEARISH KICKER CANDLESTICK PATTERN Where do I place STOP LOSE ?

It is very easy to set stoploss in Bearish Kicker Candlestick Pattern. The first bullish candle in the candle pattern is the stoploss, which should be placed a little above its high.

Where to set the target in BEARISH KICKER CANDLESTICK PATTERN?

It is considered very easy to set targets in this, we have to set targets after seeing the support or we should set targets at two or three times of our stop loss.

Instagram click here

https://www.instagram.com/smartstockadda?igsh=NmloZHgyMTBzcnoz

YouTube channel click here

https://youtube.com/@smartstockadda1?si=wQIeoYfvTebfjCiY

Facebook page click here https://www.facebook.com/profile.php?id=61558073196066&mibextid=ZbWKwL