THREE OUTSIDE UP

we are seeing this pattern on the chart this type :-

What is the three outside up candlestick pattern ?

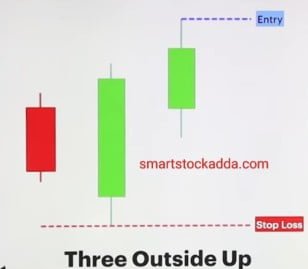

The Three Outside Up Candle Stick pattern is a bullish trend reversal pattern. It is formed at the bottom of the chart after which an upward or bullish trend starts in the market. It consists of three candles, hence in what category do we consider Triple Candlestick Pattern.

similer candle stick pattern three outside down read know :-https://smartstockadda.com/three-outside-down-candlestick-pattern/

CANDLE FORMATION OF THREE OUTSIDE UP CANDLESTICK PATTERN?

In the Three Outside Up Candlestick Pattern, we will see the candles being formed in the following manner:-

- First candle :- Color – Red. This candle will be a small bearish candle or bearish candle.

- Second candle: Color – Green. This will be a big bullish candle which will indicate a bullish or bullish trade. It opens the gap below the first candle and closes above the first candle. The first candle will be completely pushed out by the second candle. Both the first and second candles together form a bullish engulfing pattern.

- Third candle :- Color :- Green. This candle opens just above the middle of the second candle, and closes above the second candle.

How to identify the Three Outside up candlestick pattern?

To identify this candle stick pattern, we have to keep the following things in mind: –

- The candlestick pattern of Three Outside indicates an uptrend in the market.

- During the downtrend we will see it forming at the support.

- The first candle in this will be bearish candle.

- The second and third candles will be bullish candles.

- This candlestick pattern is formed on support during recession due to which the market gets bullish.

- First Candle: Red

- Second candle: green

- Third candle :- green

- The first two candles together form a bullish engulfing double candle stick pattern.

- It consists of three candles.

- Importance of this candlestick pattern occurs only when it is formed at the bottom of the chart. If this candlestick pattern is formed somewhere in the middle or above the chart, then it has no importance.

Relationship between volume and indicator in the Three Outside up candlestick pattern ?

In the Three Outside candlestick pattern, the volume of the first candle should be less than the second candle, that is, the volume of the second candle will be more than the first candle and the volume of the third candle will be more than the second candle. Volume: 1st Candle < 2nd Candle < 3rd candle For confirmation of trend reversal in three outside candlestick pattern, we should use RSI and MACD indicators as indicators.

Open demet account angle one click here : https://angel-one.onelink.me/Wjgr/9v76ufmo with 15rs/order brokreage charges top 100 users limited offer.

Psychology behind the formation of three outside up candlesticks ?

At the time of formation of this candlestick pattern, the market is in recession. The first candle in it indicates that the market will remain in recession because it is a bearish candle.

But immediately after this, a big bullish candle is formed which indicates that the market can now change the trend, here the sellers are becoming weak and the buyers are strengthening the market. For its confirmation, a third candle is formed, which is a bullish candle. At this time, confirmation is received that buyers have become strong and sellers have become weak in the market.

Now there will be a trend change in the market and the market will go into uptrend.

Use of Three Outside Up Candlestick Pattern in Trading ?

We will use it to see three things: –

Entry stoploss target

Entry:- If the support pattern is formed, then after breaking the high point of the 3rd candle, we enter the market.

stoploss:-In this candlestick pattern we should set the stop loss at the low point of the second candle.

Target:- In this candlestick pattern, the target should be set two or three times the stoploss or after seeing the resistance.

Instagram click here

https://www.instagram.com/smartstockadda?igsh=NmloZHgyMTBzcnoz

YouTube channel click here

https://youtube.com/@smartstockadda1?si=wQIeoYfvTebfjCiY

Facebook page click here https://www.facebook.com/profile.php?id=61558073196066&mibextid=ZbWKwL