What is the Three Inside Down Candlestick Pattern ?

- This is a triple candlestick pattern which indicates a recession/down fall in the market.

- This candlestick pattern is formed at resistance.

- This is a down trade candle stick pattern.

CANDLES FORMATION OF THREE INSIDE DOWN CANDLESTICK PATTERN ?

Types of candle formation in the Three Inside Down candlestick pattern

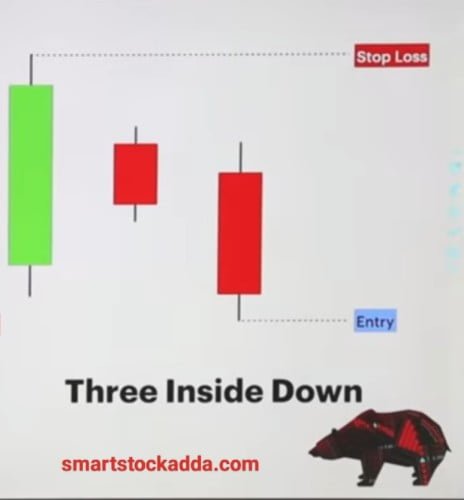

1st candle:- This is a big bullish candle.

Color :- Green

2nd Candle:- This is a small bearish candle which shows the possibility of recession in the market.

Color :- Red

3rd candle:- This is a big bearish candle which indicates that a recession is about to come in the market.

Color :- Red

Use of Three Inside Down Candlestick Pattern in Trading ?

If we know this candle stick pattern then it becomes very easy to withdraw money from the market and we will insist on using it in trading.

- Entry:- After this candlestick pattern is formed at the resistance, I have to enter the market from whichever of the next few candles breaks the low of the third candle.

- Stoploss:- In the three inside down pattern, we have to set the stop loss at the high point of the first candle.

- Target:- In this candle stick pattern, we should set the target by two or three times the stoploss or by looking at the support.

How to identify the Three Inside Down candlestick pattern ?

To identify the Three Inside Down candlestick pattern, we have to keep the following things in mind: –

- This candlestick pattern should form at resistance during an uptrend.

- First Candle:- This candle should be a big bullish candle which indicates continuation of the ongoing bullish trend in the market. Its color will be green.

- Second Candle:- This is a small bearish candle whose open price is around or slightly below the closing price of the first candle. And its closing price is between the open price of the first candle and the middle part. The thing to keep in mind here is that the second candle should be 50% of the body of the first candle.

- Third Candle:- Formation of the third candle: Its open price should be around the middle of the second candle and its closing point should be somewhere below or near the low price of the first candle.

- The thing to keep in mind is that the first and second candles together form a Bearish Harami pattern.

Features of Three Inside Down Candlestick Pattern and things to keep in mind ?

- It is created during the update.

- After the formation of three inside down candlestick patterns, the market goes into a down trend or there is a recession in the market.

- This is a triple candlestick pattern

- It consists of three candles in which the first candle is a big bullish candle and the second and third are bearish candles.

- The volume of the third candle should be more than the first and second candles, only then it is effective.

- Its construction should always create resistance.

- If this candlestick pattern is formed at the bottom of the chart or somewhere in the middle of the chart, then it has no significance, it could be a fake candle pattern.

Psychology of formation of Three Inside Down Candlestick Pattern?

When the market continues to move upward, it reaches a high point and a large bullish candle is formed there, which indicates that the market will continue to rise, but immediately after that, a small bearish candle is formed. Is Which indicates that sellers have entered the market and the third candle is formed as a big bearish candle, after which we get confirmation that buyers are becoming weak in the market and sellers have become dominant. After this the down fall starts in the market.

Instagram click here

https://www.instagram.com/smartstockadda?igsh=NmloZHgyMTBzcnoz

YouTube channel click here

https://youtube.com/@smartstockadda1?si=wQIeoYfvTebfjCiY

Facebook page click here https://www.facebook.com/profile.php?id=61558073196066&mibextid=ZbWKwL