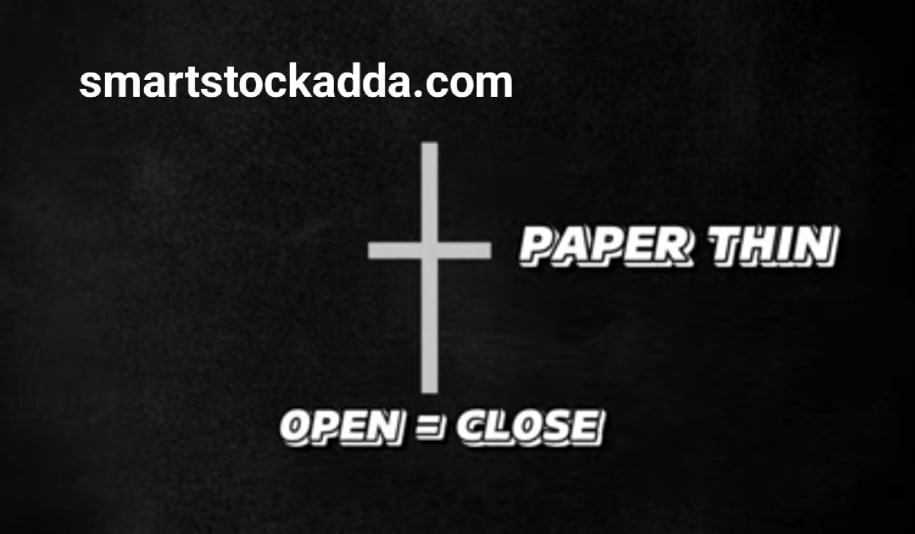

How to identify a Long-Legged Doji Candle?

- To recognize the Long-Legged Doji pattern,

- the candle’s body is positioned in the middle and the upper and lower shadows are significantly long.

- Its actual body is small with the open and closing points very close together.

- The shadow, or shade, is much longer.

- This helps you identify that it’s a Long-Legged Doji candle pattern.

All single candle stiicks pattern in full detailed : https://smartstockadda.com/category/candle-stick-eg/single-candle-stick-pattern-eg/

Definition of Long Legged Doji Candlestick ?

Consider a scenario where a stock opens, moves upwards, then retraces back to the opening point, and finally closes near the opening point. In such a case, the candlestick formed is termed as a long-legged doji candle pattern, or simply a long-legged candle pattern. As depicted in the image of a long-legged doji, the candlestick has long shadows.

What is the color of a Long Legged Doji Candle?

The color of a long-legged doji candle can be red, white, black, green, or it can even be colorless. However, it tends to be very small, almost negligible in size.

The Significance of Long-Legged Doji Candle!

MEANING OF LONG-LEGGED DOJI

- A long-legged doji candle can either occur in an uptrend or a downtrend. Simply put, the long-legged doji candlestick pattern indicates that the market could experience a reversal or continue in the same direction.

- If a long-legged doji candle forms in an uptrend, it signals that a reversal might occur, and the market could enter a downtrend.

- If the market is in a downtrend and a long-legged doji forms, it suggests that a reversal might happen, and the market could enter an uptrend.

- To confirm these signals, we also need to consider the volume before making any decisions.

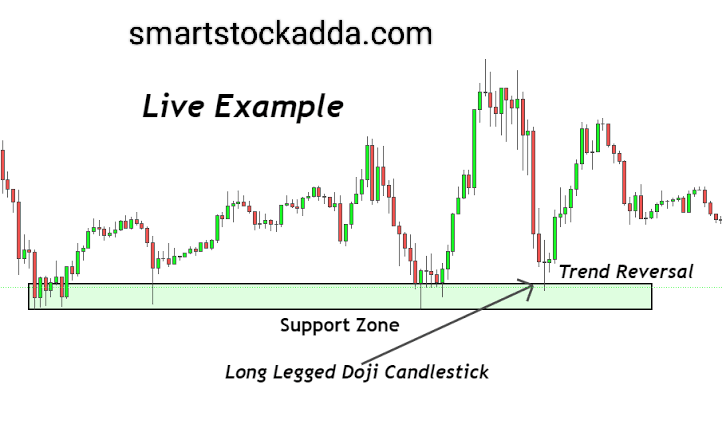

How to Use Long-Legged Doji Candle in Trading?

As you can see in the chart, the market was in a downtrend, and then it formed a long-legged doji candle. After the formation of the long-legged doji candle, it formed a bullish candle, indicating that the market might go up and move towards an uptrend. It’s noteworthy that the market approached a support zone before moving into an uptrend. Therefore, it’s essential to note that if a long-legged doji candlestick pattern forms near a resistance or support zone, it could be a proper indication of a possible market reversal.

Now, looking at this picture, we see a dogi candlestick with long legs forming in a candle stand. After that, the market started moving in a downtrend. In this, the market was also in an uptrend, and then it formed a long dogi candle, followed by forming a bearish candlestick pattern. From this, we got confirmation that the market will now go down. After that, the market started moving in a downtrend.

From these two pictures, it is evident that a long-legged dogi candle can form both in an uptrend and in a downtrend. If it forms in a downtrend, the market will move in an uptrend, and if it forms in an uptrend, the market will move in a downtrend.

Angle one मैं demat account :- https://angel-one.onelink.me/Wjgr/9v76ufmo

How to set a stop loss in a Long-Legged Doji Candle?

If a long-legged doji candle forms in a downtrend market, we need to set the stop loss at its low point.

If the market is in an uptrend and a long-legged doji candle forms at the top of the uptrend, we should set the stop loss at the high of the long-legged doji candle before trading.

After the formation of a long-legged doji candle, how to enter trading?

Entering trading after the formation of a long-legged doji candle is quite simple.

If we see a long-legged candle forming in a downtrend, we need to wait for a bullish candle to confirm the uptrend reversal. Once a bullish candle is confirmed, we should enter the trade on the next candle.

If a long-legged doji candle forms after a downtrend in the market, we should wait for a bearish candle pattern to confirm that the market will move downward. It is essential to wait for a bearish candle for confirmation, and then we should enter the trade on the subsequent candle.

How to set a target in a long-legged doji candle?

After the formation of a long-legged doji candle in the market, when we enter, our stop loss (SL) should be set at three or four times the size. Alternatively, we should set the target by looking at support and resistance levels.

Instagram:- https://www.instagram.com/smart_stock_adda?igsh=MWk3Z2VoZGZhMDg3dg==

WhatsApp:– https://chat.whatsapp.com/BH4rxUvKCUQ7D7njjCwbHwhttps://chat.whatsapp.com/BH4rxUvKCUQ7D7njjCwbHw