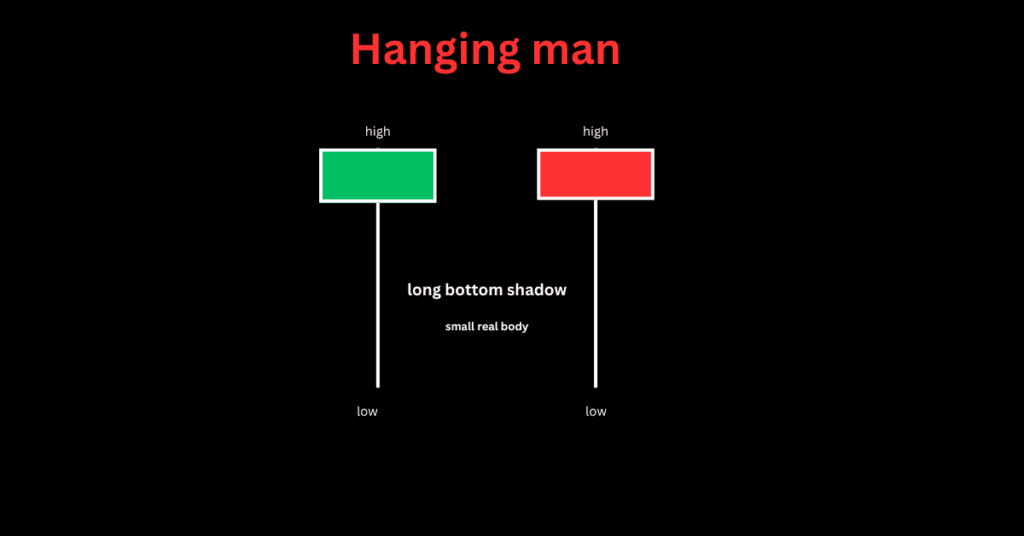

Hanging Man Candlestick Pattern Kya Hai?

Hanging man candlestick pattern ek bearish reversal pattern hai jo price chart par dikhai deta hai. Yeh pattern tab banta hai jab price kisi uptrend mein hoti hai aur phir ek chhodi body ke saath down close hota hai. Is candle ka shadow uski body se kaafi lamba hota hai, jo price ki strength ko show karta hai. Trading me ise samajhna bahut zaroori hai.

Hanging Man Pattern Features

Is pattern ki kuch khas features hain jinko humein dhyaan mein rakhna chahiye:

- Hanging man ke form hone par hamesha confirmatory volume dekhna chahiye.

- Yeh pattern sirf bullish trend ke baad hi banta hai, jo bearish reversal ka indication hai.

- Candle ka shadow candle ki body ke proportion mein zabardast lamba hona chahiye.

Hanging Man ke sath Trading

Agar aap hanging man pattern par trade karna chahte hain, toh in bullet points ko zaroor note karein:

- Confirm hone ka intezaar karein: Jab hanging man pattern banta hai, toh market me confirmation ka intezaar karein.

- Stop loss set karo: Apne risk ko control karne ke liye stop loss zaroor set karein.

- Target pahle se fix karo: Trade entry ke waqt hi apne target set karna mat bhooliye.

FAQ

- Hanging Man candlestick kya hota hai? Hanging Man ek bearish reversal pattern hai jo ek long uptrend ke baad appear hota hai.

- Hanging Man pattern kaise identify karte hain? Hanging Man ka body chhota hota hai, aur uska lower shadow kaafi lamba hota hai, jo market mein reversal ka signal deta hai.

- Hanging Man ko kab confirm karte hain? Jab next candle Hanging Man ke baad bearish hoti hai, tab pattern confirm hota hai.

- Hanging Man pattern ka significance kya hai? Hanging Man market mein trend reversal ya weakness ka indication deta hai.

- Hanging Man pattern ka size kya hona chahiye? Hanging Man ka body chhota hona chahiye, aur lower shadow kam se kam body ke double size ka hona chahiye.

- Hanging Man pattern ka reversal kaise hota hai? Agar Hanging Man ke baad bearish candlestick form hoti hai, toh price ne uptrend se downtrend mein reversal kiya hai.

- Hanging Man aur Doji mein difference kya hai? Hanging Man mein lamba lower shadow hota hai, jabki Doji ka body center par hota hai aur shadow bhi barabar hota hai.

- Hanging Man ko kis timeframe mein dekhna chahiye? Hanging Man ko higher timeframes (like daily ya weekly) par dekhna zyada reliable hota hai.

- Hanging Man pattern kis market mein kaam karta hai? Yeh pattern kisi bhi market mein kaam karta hai, jaise stocks, forex, ya crypto.

- Hanging Man ke baad market mein fall hone ki probability kitni hoti hai? Agar Hanging Man ke baad strong bearish signal aata hai, toh market mein fall hone ki probability zyada hoti hai.

- Hanging Man pattern ko kaise trade karte hain? Hanging Man ke baad short positions open karte hain, jab next candle confirm bearish hoti hai.

- Hanging Man aur Shooting Star mein kya fark hai? Dono pattern similar hain, lekin Hanging Man uptrend ke baad aata hai, aur Shooting Star downtrend ke baad.

- Hanging Man pattern ko kab ignore karna chahiye? Agar volume low ho ya market trend unclear ho, toh Hanging Man ko ignore karna chahiye.

- Hanging Man pattern ka use risk management mein kaise hota hai? Hanging Man ke baad stop-loss set karke risk management ki strategy improve ki ja sakti hai.

- Hanging Man ka success rate kitna hai? Hanging Man ka success rate zyada tab hota hai jab market mein strong trend aur volume hota hai