Dragonfly Doji Kya Hota Hai?

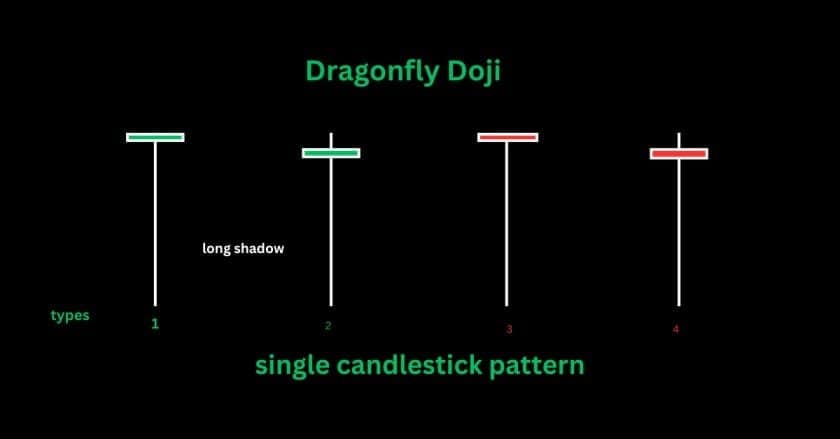

Dragonfly Doji candlestick pattern ek aisa signal hai jo market reversal ki taraf ishara karta hai. Yeh pattern tab banta hai jab open price aur close price ek hi level par hota hai, lekin market ek naya low banane ke liye neeche jata hai aur fir wapas aakar highest level par settle ho jata hai. Isse market bullish sentiments ka darshan hota hai.

Dragonfly Doji ke Features

Yeh pattern kuch khaas features se bhara hota hai:

- Ek chhoti body jo opening aur closing price ko dikhati hai.

- Badi lower shadow jo ki market ki lower rejection ko dikhati hai.

- Upper shadow nahi hota ya bahut chhota hota hai.

Trading ke Sath Dragonfly Doji ka Upyog

Dragonfly Doji ka istemal trading ke liye kai tarike se kiya ja sakta hai.

- Is pattern ke bante hi bullish confirmation ka intezaar karein.

- Stop loss ko recent low ke neeche rakhein.

- Target price ko strong resistance levels ke aas-paas set karein.

Dragonfly Doji candlestick pattern trading ke liye ek powerful tool hai. Is pattern ka samajhna aur upyog karna aapko trading mein better decision lene mein madad karega. Lagatar practice karke, aap ise apne trading strategies mein successfully integrate kar sakte hain.

Dragonfly Doji FAQs in Hinglish

1. Dragonfly Doji kya hota hai?

Dragonfly Doji ek candlestick pattern hai jo tab banta hai jab open, high, aur close price almost ek jaisi hoti hai, aur ek lambi lower shadow dikhai deti hai.

2. Is pattern ka naam Dragonfly kyun hai?

Iska shape ek dragonfly ke jaise lagta hai, jisme upper body chhoti ya absent hoti hai, aur ek lambi tail hoti hai.

3. Dragonfly Doji bullish hota hai ya bearish?

Yeh zyada tar bullish hota hai, lekin iska context (support zone ya trend) aur confirmation zaroori hai.

4. Yeh pattern kab banta hai?

Yeh tab banta hai jab sellers price ko neeche le jaane ki koshish karte hain, lekin buyers ne price ko close tak wapas kheench liya.

5. Dragonfly Doji ko kaise identify karein?

Is pattern me candle ka body part chhota ya absent hota hai, aur ek lambi lower shadow hoti hai.

6. Dragonfly Doji hamesha reversal signal deta hai?

Nahi, yeh hamesha reversal ka signal nahi deta, lekin zyada tar cases me bullish reversal hone ke chances hote hain.

7. Is pattern ko confirm kaise karein?

Next candle ka direction dekhkar pata lagta hai ki market bullish hoga ya nahi.

8. Yeh pattern kis time frame me zyada reliable hai?

Higher time frames (daily, weekly) par yeh zyada strong aur reliable hota hai.

9. Support aur Resistance ke paas iska kya role hai?

Agar yeh support zone ke paas dikhe, toh bullish reversal ka strong signal deta hai.

10. Indicators ke saath Dragonfly Doji kaise use karein?

RSI, Stochastic Oscillator, aur Volume indicators ke saath ise use karke confirmation liya jaa sakta hai.

11. Dragonfly Doji ke baad stop-loss kahan lagana chahiye?

Stop-loss is candle ke low ke thoda neeche lagana safe hota hai.

12. Target kaise set karein?

Target risk-reward ratio ke hisaab se ya resistance levels ko dekhkar set karein.

13. Trending market me iska kya importance hai?

Trending market me yeh trend continuation ya reversal ka signal de sakta hai, lekin context zaroor dekhna chahiye.

14. Sideways market me Dragonfly Doji ka significance kya hai?

Sideways market me yeh breakout ka signal ho sakta hai, especially agar support zone ke paas ho.

15. New traders ke liye Dragonfly Doji kaise helpful hai?

New traders ise bullish sentiment aur support zone pe buyer dominance samajhne ke liye use kar sakte hain, aur better entries le sakte hain.