Hammer Candlestick pattern kya hai

Hammer candle, yaani ki hammer pattern, ek financial chart analysis ka tool hai jo market ke reversal trends ko identify karne mein madad karta hai. Iska naam isliye pada kyunki iski shape ek hammer ki tarah hoti hai. Jab market downtrend mein hota hai aur ek hammer candle banata hai, to yeh sign hota hai ki buyers market ko support dene ke liye tayaar hain.

Hammer Candle Ki Visheshtayein

Hammer candle ki pehchaan uski unique shape se hoti hai; iski body chhoti hoti hai aur shadow (wick) lambi hoti hai. Jab ek hammer candle present hota hai, to iska matlab hai ki market mein kuch volatility hai. Yeh price movement ko samajhne ka ek acha tareeka hai, kyunki yeh market sentiment ko show karta hai. Agar yeh candle uptrend ke baad banata hai, to yeh bullish reversal ka signal hota hai.

Hammer Candle Ke sath trading kaise karen

Trading strategies mein hammer candle ka istemal karke traders price action par nazar rakh sakte hain. Jab traders ek hammer candle dekhte hain, to wo zyada chances par market entry karne ka sochte hain. Hammer candle ke baad agar next candle bullish hoti hai, to wo entry point ki confirmation hoti hai. Is tarike se, hammer candle analysis se trading decisions ko behtar banane mein madad mil sakti hai.

FAQ

1. Hammer Candle kya hai?

Yeh ek bullish reversal pattern hai jo price ke neeche se upar jane ka sanket deta hai.

2. Iska shape kaisa hota hai?

Chhoti body hoti hai aur neeche ki wick (shadow) lambi hoti hai, jo body se kam se kam 2x hoti hai.

3. Hammer Candle kaise banta hai?

Tab banta hai jab price session ke dauraan neeche jata hai, lekin wapas recover karke upar close karta hai.

4. Hammer kis time frame mein dekhna chahiye?

Minimum 15-minute ya usse zyada, jaise hourly, daily, ya weekly charts pe zyada reliable hota hai.

5. Iska kaunsa trend pehle hona chahiye?

Yeh downtrend ke baad hi banta hai, tabhi iska significance hota hai.

6. Volume ka kya role hai?

Zyada volume ke sath hammer banta hai toh woh jyada reliable hota hai.

7. Confirmation candle ka kya importance hai?

Hammer ke baad agar ek bullish candle banti hai, toh yeh price reversal confirm karta hai.

8. Hammer aur Doji mein kya difference hai?

Doji mein body almost nahi hoti, lekin hammer mein chhoti body aur lambi lower wick hoti hai.

9. Hammer aur Hanging Man mein kya farq hai?

Hammer bullish hota hai aur downtrend ke baad banta hai, Hanging Man bearish hota hai aur uptrend ke baad banta hai.

10. Stop-loss kaha lagana chahiye?

Hammer candle ke low ke neeche stop-loss lagana sabse safe hota hai.

11. Target kaise decide karein?

Nearest resistance level ya 1:2 risk-reward ratio ka formula follow karein.

12. Kya hammer har baar kaam karta hai?

Nahi, yeh context aur confirmation candle ke bina kaam nahi karega.

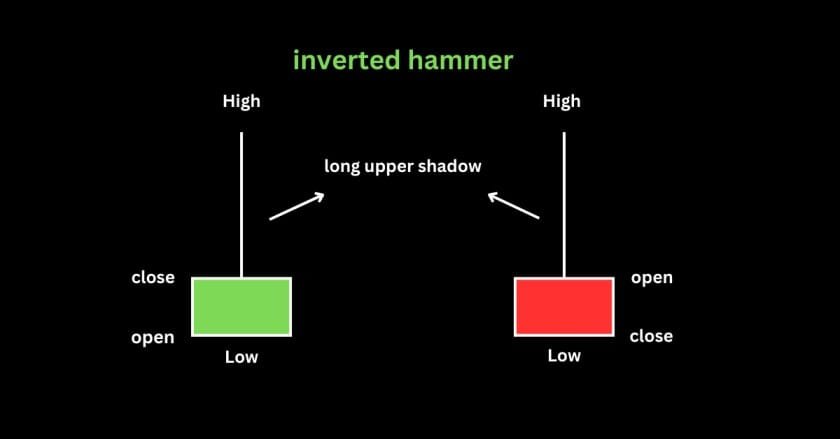

13. Inverted Hammer kya hota hai?

Inverted Hammer ek bullish reversal pattern hai, lekin iska upper shadow lamba hota hai.

14. Yeh pattern kis market ke liye kaam karega?

Stocks, indices, forex, aur commodities sabke liye applicable hai.

15. Hammer candle trading ke liye indicators kaunsa use karein?

RSI, MACD, ya Moving Averages ke sath hammer ko confirm karein.